Applications for the LAMP Fellowship 2025-26 will open soon. Sign up here to be notified when the dates are announced.

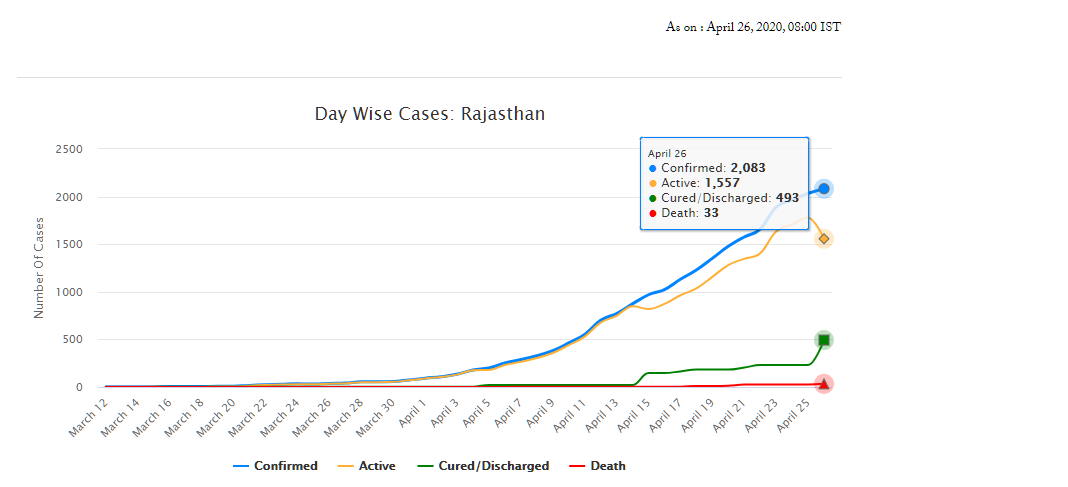

As of April 26, Rajasthan has 2,083 confirmed cases of COVID-19 (fifth highest in the country), of which 493 have recovered and 33 have died. On March 18, the Rajasthan government had declared a state-wide curfew till March 31, to check the spread of the disease. A nation-wide lockdown has also been in place since March 25 and is currently, extended up to May 3. The state has announced several policy decisions to prevent the spread of the virus and provide relief for those affected by it. This blog summarises the key policy measures taken by the Government of Rajasthan in response to the COVID-19 pandemic.

Early measures for containment

Between late January and early February, Rajasthan Government’s measures were aimed towards identification, screening and testing, and constant monitoring of passenger arrivals from China. Instructions were also issued to district health officials for various prevention, treatment, & control related activities, such as (i) mandatory 28-day home isolation for all travellers from China, (ii) running awareness campaigns, and (iii) ensuring adequate supplies of Personal Protection Equipments (PPEs). Some of the other measures, taken prior to the state-wide lockdown, are summarised below:

Administrative measures

The government announced the formation of Rapid Response Teams (RRTs), at the medical college-level and at district-level on March 3 and 5, respectively.

The District Collector was appointed as the Nodal Officer for all COVID-19 containment activities. Control Rooms were to be opened at all Sub-divisional offices. The concerned officers were also directed to strengthen information dissemination mechanisms and tackle the menace of fake news.

Directives were issued on March 11 to rural health workers/officials to report for duty on Gazetted holidays. Further, government departments were shut down between March 22 and March 31. Only essential departments such as Health Services were allowed to function on a rotation basis at 50% capacity and special / emergency leaves were permitted.

Travel and Movement

Air travellers were to undergo 14-day home isolation and were also required to provide an undertaking for the same. Besides, those violating the mandated isolation/quarantine were liable to be punished under Section. 188 of the Indian Penal Code. Penalties are imposed under this section on persons for the willful violation of orders that have been duly passed by a public servant.

All institutions and establishments, such as (i) educational institutions, theatres, and gyms, (ii) anganwadis, (iii) bars, discos, libraries, restaurants etc, (iv) museums and tourist places, were directed to be shut down till March 31.

The daily Jan Sunwai at the Chief Minister’s residence was cancelled until further notice. Various government offices were directed to shut down and exams of schools and colleges were postponed.

On March 24, the government issued a state-wide ban on the movement of private vehicles till March 31.

Health Measures

Advisories regarding prevention and control measures were issued to: (i) District Collectors, regarding sample collection and transportation, hotels, and preparedness of hospitals, (ii) Police department, to stop using breath analysers, (iii) Private hospitals, regarding preparedness and monitoring activities, and (iv) Temple trusts, to disinfect their premises with chemicals.

The government issued Standard Operating Procedures for conducting mock drills in emergency response handling of COVID-19 cases. Training and capacity building measures were also initiated for (i) Railways, Army personnel etc and (ii) ASHA workers, through video conferencing.

A model micro-plan for containing local transmission of COVID was released. Key features of the plan include: (i) identification and mapping of affected areas, (ii) activities for prevention control, surveillance, and contact tracing, (iii) human resource management, including roles and responsibilities, (iv) various infrastructural and logistical support, such as hospitals, labs etc, and (v) communication and data management.

Resource Management: Private hospitals and medical colleges were instructed to reserve 25 % of beds for COVID-19 patients. They were also instructed to utilise faculty from the departments of Preventive and Social Medicine to conduct health education and awareness activities.

Over 6000 Students of nursing schools were employed in assisting the health department to conduct screening activities being conducted at public places, railways stations, bus stands etc.

Further, the government issued guidelines to ensure the rational use of PPEs.

Welfare Measures

The government announced financial assistance, in the form of encouragement grants, to health professionals engaged in treating COVID-19 patients.

Steps were also taken by the government to ensure speedy disbursal of pensions for February and March.

The government also initiated the replacement of the biometric authentication with an OTP process for distribution of ration via the Public Distribution System (PDS).

During the lockdown

State-wide curfew announced on March 18 has been followed by a nation-wide lockdown between March 25 and May 3. However, certain relaxations have been recommended by the state government from April 21 onwards. Some of the key measures undertaken during the lockdown period are:

Administrative Measures

Advisory groups and task forces were set up on – (i) COVID-19 prevention, (ii) Health and Economy, and (iii) Higher education. These groups will provide advice on the way forward for (i) prevention and containment activities, (ii) post-lockdown strategies and strategies to revive the economy, and (iii) to address the challenges facing the higher education sector respectively.

Services of retiring medical and paramedical professionals retiring between March and August have been extended till September 2020.

Essential Goods and Services

A Drug Supply Control Room was set up at the Rajasthan Pharmacy Council. This is to ensure uninterrupted supply of medicines during the lockdown and will also assist in facilitating home delivery of medicines.

The government permitted Fair Price Shops to sell products such as masalas, sanitisers, and hygiene products, in addition to food grains.

Village service cooperatives were declared as secondary markets to facilitate farmers to sell their produce near their own fields/villages during the lockdown.

A Whatsapp helpline was also set up for complaints regarding hoarding, black marketing, and overpricing.

Travel and Movement

Once lockdown was in place, the government issued instructions to identify, screen, and categorise people from other states who have travelled to Rajasthan. They were to be categorised into: (i) people displaying symptoms to be put in isolation wards, (ii) people over 60 years of age with symptoms and co-morbidities to be put in quarantine centres, and (iii) asymptomatic people to be home quarantined.

On March 28, the government announced the availability of buses to transport people during the lockdown. Further, stranded students in Kota were allowed to return to their respective states.

On April 2, a portal and a helpline were launched to help stranded foreign tourists and NRIs.

On April 11, an e-pass facility was launched for movement of people and vehicles.

Health Measures

To identify COVID-19 patients, district officials were instructed to monitor people with ARI/URI/Pneumonia or other breathing difficulties coming into hospital OPDs. Pharmacists were also instructed to not issue medicines for cold/cough without prescriptions.

A mobile app – Raj COVID Info – was developed by the government for tracking of quarantined people. Quarantined persons are required to send their selfie clicks at regular intervals, failing which a notification would be sent by the app. The app also provides a lot of information on COVID-19, such as the number of cases, and press releases by the government.

Due to the lockdown, people had restricted access to hospitals and treatment. Thus, instructions were issued to utilise Mobile Medical Vans for treatment/screening and also as mobile OPDs.

On April 20, a detailed action plan for prevention and control of COVID-19 was released. The report recommended: (i) preparation of a containment plan, (ii) formation of RRTs, (iii) testing protocols, (iv) setting up of control room and helpline, (v) designated quarantine centres and COVID-19 hospitals, (vi) roles and responsibilities, and (vii) other logistics.

Welfare Measures

The government issued instructions to make medicines available free of cost to senior citizens and other patients with chronic illnesses through the Chief Minister’s Free Medicine Scheme.

Rs 60 crore was allotted to Panchayati Raj Institutions to purchase PPEs and for other prevention activities.

A one-time cash transfer of Rs 1000 to over 15 lakh construction workers was announced. Similar cash transfer of Rs 1000 was announced for poor people who were deprived of livelihood during the lockdown, particularly those people with no social security benefits. Eligible families would be selected through the Aadhaar database. Further, an additional cash transfer of Rs 1500 to needy eligible families from different categories was announced.

The state also announced an aid of Rs 50 lakh to the families of frontline workers who lose their lives due to COVID-19.

To maintain social distancing, the government will conduct a door-to-door distribution of ration to select beneficiaries in rural areas of the state. The government also announced the distribution of free wheat for April, May, and June, under the National Food Security Act, 2013. Ration will also be distributed to stranded migrant families from Pakistan, living in the state.

The government announced free tractor & farming equipment on rent in tie-up with farming equipment manufacturers to assist economically weak small & marginal farmers.

Other Measures

Education: Project SMILE was launched to connect students and teachers online during the lockdown. Study material would be sent through specially formed Whatsapp groups. For each subject, 30-40 minute content videos have been prepared by the Education Department.

Industry: On April 18, new guidelines were issued for industries and enterprises to resume operations from April 20 onwards. Industries located in rural areas or export units / SEZs in municipal areas where accommodation facilities for workers are present, are allowed to function. Factories have been permitted to increase the working hours from 8 hours to 12 hours per day, to reduce the requirement of workers in factories. This exemption has been allowed for the next three months for factories operating at 60% to 65% of manpower capacity.

For more information on the spread of COVID-19 and the central and state government response to the pandemic, please see here.

The issue of Non-Performing Assets (NPAs) in the Indian banking sector has become the subject of much discussion and scrutiny. The Standing Committee on Finance recently released a report on the banking sector in India, where it observed that banks’ capacity to lend has been severely affected because of mounting NPAs. The Estimates Committee of Lok Sabha is also currently examining the performance of public sector banks with respect to their burgeoning problem of NPAs, and loan recovery mechanisms available.

Additionally, guidelines for banks released by the Reserve Bank of India (RBI) in February 2018 regarding timely resolution of stressed assets have come under scrutiny, with multiple cases being filed in courts against the same. In this context, we examine the recent rise of NPAs in the country, some of their underlying causes, and steps taken so far to address the issue.

What is the extent and effect of the NPA problem in India?

Banks give loans and advances to borrowers. Based on the performance of the loan, it may be categorized as: (i) a standard asset (a loan where the borrower is making regular repayments), or (ii) a non-performing asset. NPAs are loans and advances where the borrower has stopped making interest or principal repayments for over 90 days.

As of March 31, 2018, provisional estimates suggest that the total volume of gross NPAs in the economy stands at Rs 10.35 lakh crore. About 85% of these NPAs are from loans and advances of public sector banks. For instance, NPAs in the State Bank of India are worth Rs 2.23 lakh crore.

In the last few years, gross NPAs of banks (as a percentage of total loans) have increased from 2.3% of total loans in 2008 to 9.3% in 2017 (Figure 1). This indicates that an increasing proportion of a bank’s assets have ceased to generate income for the bank, lowering the bank’s profitability and its ability to grant further credit.

Escalating NPAs require a bank to make higher provisions for losses in their books. The banks set aside more funds to pay for anticipated future losses; and this, along with several structural issues, leads to low profitability. Profitability of a bank is measured by its Return on Assets (RoA), which is the ratio of the bank’s net profits to its net assets. Banks have witnessed a decline in their profitability in the last few years (Figure 2), making them vulnerable to adverse economic shocks and consequently putting consumer deposits at risk.

What led to the rise in NPAs?

Some of the factors leading to the increased occurrence of NPAs are external, such as decreases in global commodity prices leading to slower exports. Some are more intrinsic to the Indian banking sector.

A lot of the loans currently classified as NPAs originated in the mid-2000s, at a time when the economy was booming and business outlook was very positive. Large corporations were granted loans for projects based on extrapolation of their recent growth and performance. With loans being available more easily than before, corporations grew highly leveraged, implying that most financing was through external borrowings rather than internal promoter equity. But as economic growth stagnated following the global financial crisis of 2008, the repayment capability of these corporations decreased. This contributed to what is now known as India’s Twin Balance Sheet problem, where both the banking sector (that gives loans) and the corporate sector (that takes and has to repay these loans) have come under financial stress.

When the project for which the loan was taken started underperforming, borrowers lost their capability of paying back the bank. The banks at this time took to the practice of ‘evergreening’, where fresh loans were given to some promoters to enable them to pay off their interest. This effectively pushed the recognition of these loans as non-performing to a later date, but did not address the root causes of their unprofitability.

Further, recently there have also been frauds of high magnitude that have contributed to rising NPAs. Although the size of frauds relative to the total volume of NPAs is relatively small, these frauds have been increasing, and there have been no instances of high profile fraudsters being penalised.

What is being done to address the problem of growing NPAs?

The measures taken to resolve and prevent NPAs can broadly be classified into two kinds – first, regulatory means of resolving NPAs per various laws (like the Insolvency and Bankruptcy Code), and second, remedial measures for banks prescribed and regulated by the RBI for internal restructuring of stressed assets.

The Insolvency and Bankruptcy Code (IBC) was enacted in May 2016 to provide a time-bound 180-day recovery process for insolvent accounts (where the borrowers are unable to pay their dues). Under the IBC, the creditors of these insolvent accounts, presided over by an insolvency professional, decide whether to restructure the loan, or to sell the defaulter’s assets to recover the outstanding amount. If a timely decision is not arrived at, the defaulter’s assets are liquidated. Proceedings under the IBC are adjudicated by the Debt Recovery Tribunal for personal insolvencies, and the National Company Law Tribunal (NCLT) for corporate insolvencies. 701 cases have been registered and 176 cases have been resolved as of March 2018 under the IBC.

What changed recently in the RBI’s guidelines to banks?

Over the years, the RBI has issued various guidelines aimed at the resolution of stressed assets of banks. These included introduction of certain schemes such as: (i) Strategic Debt Restructuring (which allowed banks to change the management of the defaulting company), and (ii) Joint Lenders’ Forum (where lenders evolved a resolution plan and voted on its implementation). In line with the enactment of the IBC, the RBI, through a circular in February 2018, substituted all the specific pre-existing guidelines with a simplified, generic, time-bound framework for the resolution of stressed assets.

In the revised framework which replaced the earlier schemes, the RBI put in place a strict deadline of 180 days during which a resolution plan must be implemented, failing which stressed assets must be referred to the NCLT under IBC within 15 days. The framework also introduced a provision for monitoring of one-day defaults, where incipient stress is identified and flagged immediately when repayments are overdue by a day.

Borrowers whose loans were tagged as NPAs before the release of the circular recently crossed the 180-day deadline for internal resolution by banks. Some of these borrowers, including various power producers and sugar mills, had appealed against the RBI guidelines in various High Courts. A two-judge bench of the Allahabad High Court had recently ruled in favour of the RBI’s powers to issue these guidelines, and refused to grant interim relief to power producers from being taken to the NCLT for bankruptcy. All lawsuits against the circular have currently been transferred to the Supreme Court, which has now issued an order to maintain status quo on the same. This means that these cases cannot be referred to the NCLT until the Supreme Court’s decision on the circular, although the RBI’s 180-day deadline has passed. This effectively provides interim relief to the errant borrowers who had moved to court till the next hearing of the apex court on this matter, which is scheduled for November 2018.