Applications for the LAMP Fellowship 2025-26 will open soon. Sign up here to be notified when the dates are announced.

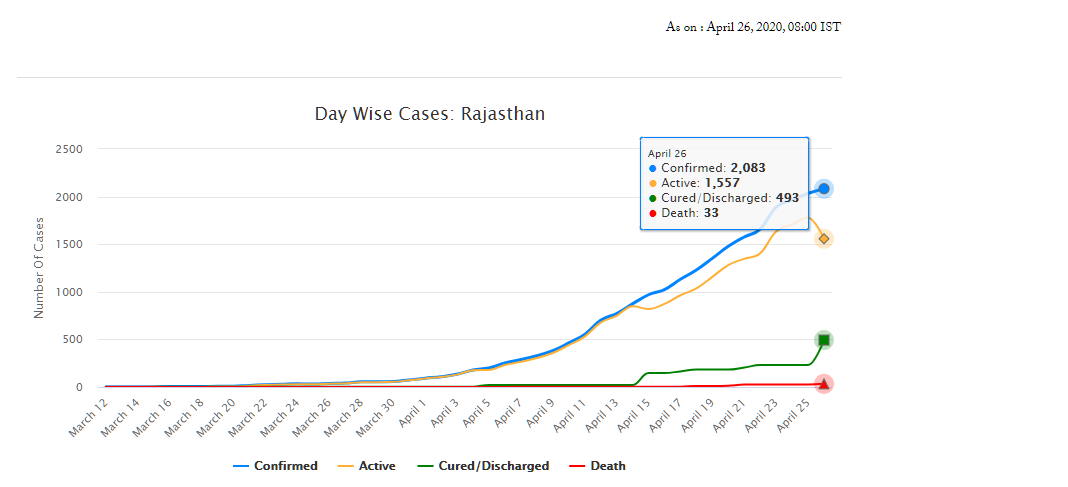

As of April 26, Rajasthan has 2,083 confirmed cases of COVID-19 (fifth highest in the country), of which 493 have recovered and 33 have died. On March 18, the Rajasthan government had declared a state-wide curfew till March 31, to check the spread of the disease. A nation-wide lockdown has also been in place since March 25 and is currently, extended up to May 3. The state has announced several policy decisions to prevent the spread of the virus and provide relief for those affected by it. This blog summarises the key policy measures taken by the Government of Rajasthan in response to the COVID-19 pandemic.

Early measures for containment

Between late January and early February, Rajasthan Government’s measures were aimed towards identification, screening and testing, and constant monitoring of passenger arrivals from China. Instructions were also issued to district health officials for various prevention, treatment, & control related activities, such as (i) mandatory 28-day home isolation for all travellers from China, (ii) running awareness campaigns, and (iii) ensuring adequate supplies of Personal Protection Equipments (PPEs). Some of the other measures, taken prior to the state-wide lockdown, are summarised below:

Administrative measures

The government announced the formation of Rapid Response Teams (RRTs), at the medical college-level and at district-level on March 3 and 5, respectively.

The District Collector was appointed as the Nodal Officer for all COVID-19 containment activities. Control Rooms were to be opened at all Sub-divisional offices. The concerned officers were also directed to strengthen information dissemination mechanisms and tackle the menace of fake news.

Directives were issued on March 11 to rural health workers/officials to report for duty on Gazetted holidays. Further, government departments were shut down between March 22 and March 31. Only essential departments such as Health Services were allowed to function on a rotation basis at 50% capacity and special / emergency leaves were permitted.

Travel and Movement

Air travellers were to undergo 14-day home isolation and were also required to provide an undertaking for the same. Besides, those violating the mandated isolation/quarantine were liable to be punished under Section. 188 of the Indian Penal Code. Penalties are imposed under this section on persons for the willful violation of orders that have been duly passed by a public servant.

All institutions and establishments, such as (i) educational institutions, theatres, and gyms, (ii) anganwadis, (iii) bars, discos, libraries, restaurants etc, (iv) museums and tourist places, were directed to be shut down till March 31.

The daily Jan Sunwai at the Chief Minister’s residence was cancelled until further notice. Various government offices were directed to shut down and exams of schools and colleges were postponed.

On March 24, the government issued a state-wide ban on the movement of private vehicles till March 31.

Health Measures

Advisories regarding prevention and control measures were issued to: (i) District Collectors, regarding sample collection and transportation, hotels, and preparedness of hospitals, (ii) Police department, to stop using breath analysers, (iii) Private hospitals, regarding preparedness and monitoring activities, and (iv) Temple trusts, to disinfect their premises with chemicals.

The government issued Standard Operating Procedures for conducting mock drills in emergency response handling of COVID-19 cases. Training and capacity building measures were also initiated for (i) Railways, Army personnel etc and (ii) ASHA workers, through video conferencing.

A model micro-plan for containing local transmission of COVID was released. Key features of the plan include: (i) identification and mapping of affected areas, (ii) activities for prevention control, surveillance, and contact tracing, (iii) human resource management, including roles and responsibilities, (iv) various infrastructural and logistical support, such as hospitals, labs etc, and (v) communication and data management.

Resource Management: Private hospitals and medical colleges were instructed to reserve 25 % of beds for COVID-19 patients. They were also instructed to utilise faculty from the departments of Preventive and Social Medicine to conduct health education and awareness activities.

Over 6000 Students of nursing schools were employed in assisting the health department to conduct screening activities being conducted at public places, railways stations, bus stands etc.

Further, the government issued guidelines to ensure the rational use of PPEs.

Welfare Measures

The government announced financial assistance, in the form of encouragement grants, to health professionals engaged in treating COVID-19 patients.

Steps were also taken by the government to ensure speedy disbursal of pensions for February and March.

The government also initiated the replacement of the biometric authentication with an OTP process for distribution of ration via the Public Distribution System (PDS).

During the lockdown

State-wide curfew announced on March 18 has been followed by a nation-wide lockdown between March 25 and May 3. However, certain relaxations have been recommended by the state government from April 21 onwards. Some of the key measures undertaken during the lockdown period are:

Administrative Measures

Advisory groups and task forces were set up on – (i) COVID-19 prevention, (ii) Health and Economy, and (iii) Higher education. These groups will provide advice on the way forward for (i) prevention and containment activities, (ii) post-lockdown strategies and strategies to revive the economy, and (iii) to address the challenges facing the higher education sector respectively.

Services of retiring medical and paramedical professionals retiring between March and August have been extended till September 2020.

Essential Goods and Services

A Drug Supply Control Room was set up at the Rajasthan Pharmacy Council. This is to ensure uninterrupted supply of medicines during the lockdown and will also assist in facilitating home delivery of medicines.

The government permitted Fair Price Shops to sell products such as masalas, sanitisers, and hygiene products, in addition to food grains.

Village service cooperatives were declared as secondary markets to facilitate farmers to sell their produce near their own fields/villages during the lockdown.

A Whatsapp helpline was also set up for complaints regarding hoarding, black marketing, and overpricing.

Travel and Movement

Once lockdown was in place, the government issued instructions to identify, screen, and categorise people from other states who have travelled to Rajasthan. They were to be categorised into: (i) people displaying symptoms to be put in isolation wards, (ii) people over 60 years of age with symptoms and co-morbidities to be put in quarantine centres, and (iii) asymptomatic people to be home quarantined.

On March 28, the government announced the availability of buses to transport people during the lockdown. Further, stranded students in Kota were allowed to return to their respective states.

On April 2, a portal and a helpline were launched to help stranded foreign tourists and NRIs.

On April 11, an e-pass facility was launched for movement of people and vehicles.

Health Measures

To identify COVID-19 patients, district officials were instructed to monitor people with ARI/URI/Pneumonia or other breathing difficulties coming into hospital OPDs. Pharmacists were also instructed to not issue medicines for cold/cough without prescriptions.

A mobile app – Raj COVID Info – was developed by the government for tracking of quarantined people. Quarantined persons are required to send their selfie clicks at regular intervals, failing which a notification would be sent by the app. The app also provides a lot of information on COVID-19, such as the number of cases, and press releases by the government.

Due to the lockdown, people had restricted access to hospitals and treatment. Thus, instructions were issued to utilise Mobile Medical Vans for treatment/screening and also as mobile OPDs.

On April 20, a detailed action plan for prevention and control of COVID-19 was released. The report recommended: (i) preparation of a containment plan, (ii) formation of RRTs, (iii) testing protocols, (iv) setting up of control room and helpline, (v) designated quarantine centres and COVID-19 hospitals, (vi) roles and responsibilities, and (vii) other logistics.

Welfare Measures

The government issued instructions to make medicines available free of cost to senior citizens and other patients with chronic illnesses through the Chief Minister’s Free Medicine Scheme.

Rs 60 crore was allotted to Panchayati Raj Institutions to purchase PPEs and for other prevention activities.

A one-time cash transfer of Rs 1000 to over 15 lakh construction workers was announced. Similar cash transfer of Rs 1000 was announced for poor people who were deprived of livelihood during the lockdown, particularly those people with no social security benefits. Eligible families would be selected through the Aadhaar database. Further, an additional cash transfer of Rs 1500 to needy eligible families from different categories was announced.

The state also announced an aid of Rs 50 lakh to the families of frontline workers who lose their lives due to COVID-19.

To maintain social distancing, the government will conduct a door-to-door distribution of ration to select beneficiaries in rural areas of the state. The government also announced the distribution of free wheat for April, May, and June, under the National Food Security Act, 2013. Ration will also be distributed to stranded migrant families from Pakistan, living in the state.

The government announced free tractor & farming equipment on rent in tie-up with farming equipment manufacturers to assist economically weak small & marginal farmers.

Other Measures

Education: Project SMILE was launched to connect students and teachers online during the lockdown. Study material would be sent through specially formed Whatsapp groups. For each subject, 30-40 minute content videos have been prepared by the Education Department.

Industry: On April 18, new guidelines were issued for industries and enterprises to resume operations from April 20 onwards. Industries located in rural areas or export units / SEZs in municipal areas where accommodation facilities for workers are present, are allowed to function. Factories have been permitted to increase the working hours from 8 hours to 12 hours per day, to reduce the requirement of workers in factories. This exemption has been allowed for the next three months for factories operating at 60% to 65% of manpower capacity.

For more information on the spread of COVID-19 and the central and state government response to the pandemic, please see here.

Over the last two months, the centre and over 15 states have passed laws to levy the Goods and Services Tax (GST). Under these laws, tax rates recommended by the GST Council will be notified by the government. The Council met in Srinagar last week to approve rates for various items. Following this decision, the government has indicated that it may invoke provisions under the GST laws to monitor prices of goods and services.[1] This will be done by setting up an anti-profiteering authority to ensure that reduction in tax rates under GST results in a fall in prices of goods and services. In this context, we look at the rates approved by the GST Council, and the role of the proposed authority to ensure that prices of various items do not increase under GST.

Q. What are the tax rates that have been approved by the Council?

The Council has classified various items under five different tax rates: (i) 5%, (ii) 12%, (iii) 18%, (iv) 28%, and (v) 28% with an additional GST compensation cess (see Table 1).[2],[3],[4] While tax rates for most of the goods and services have been approved by the Council, rates for some remaining items such as biscuits, textiles, footwear, and precious metals are expected to be decided in its next meeting on June 3, 2017.

Table 1: Tax rates for goods and services as approved by the GST Council

| 5% | 12% | 18% | 28% | 28% + Cess | |

|---|---|---|---|---|---|

| Goods |

|

|

|

|

|

| Services |

|

|

|

|

Source: GST Council Press Release, Central Board for Excise and Customs.

Q. Will GST apply on all goods and services?

No, certain items such as alcohol for human consumption, and petroleum products such as petrol, diesel and natural gas will be exempt under GST. In addition to these, the GST Council has also classified certain items under the 0% tax rate, implying that GST will not be levied on them. This list includes items of daily use such as wheat, rice, milk, eggs, fresh vegetables, meat and fish. Some services such as education and healthcare will also be exempt under GST.

Q. How will GST impact prices of goods and services?

GST subsumes various indirect taxes and seeks to reduce cascading of taxes (tax on tax). With greater efficiency in the supply of products, enhanced flow of tax credits, removal of border check posts, and changes in tax rates, prices of goods and services may come down.[5],[6],[7] Mr Arun Jaitley recently stated that the Council has classified several items under lower tax rates, when compared to the current system.[8]

However, since some tax rates such as VAT currently vary across states, the real impact of GST rates on prices may become clear only after its roll-out. For example, at present VAT rates on smart phones range between 5-15% across states. Under GST they will be taxed at 12%.[9] As a result while phones may become marginally cheaper in some states, their prices may go up in some others.

Q. What happens if tax rates come down but companies don’t reduce prices?

Few people such as the Union Revenue Secretary and Finance Ministers of Kerala and Jammu and Kashmir have expressed concerns that companies may not lower their prices despite a fall in tax rates, in order to increase their profits. The Revenue Secretary also stated that the government had received reports of few businesses increasing their product prices in anticipation of GST.[10]

To take care of such cases, the GST laws contain a provision which allows the centre to constitute an anti-profiteering authority. The authority will ensure that a reduction in tax rates under GST is passed on to the consumers. Specific powers and functions of the authority will be specified by the GST Council.[11],[12]

Q. Are there any existing mechanisms to regulate pricing of products?

Various laws have been enacted over the years to control the pricing of essential items, or check for unfair market practices. For example, the Essential Commodities Act, 1955 controls the price of certain necessary items such as medicines, food items and fertilisers.[13]

Parliament has also created statutory authorities like the Competition Commission of India to check against unfair trade practices such as cartelisation by businesses to inflate prices of goods. Regulators, such as the National Pharmaceutical Pricing Authority, are also responsible for regulating prices for items in their sectors.

Q. Could there be some challenges in implementing this mechanism?

To fulfil its mandate, the anti-profiteering authority could get involved in determining prices of various items. This may even require going through the balance sheets and finances of various companies. Some argue that this is against the idea of prices being determined by market forces of demand and supply.[14]

Another aspect to consider here is that the price of items is dependent on a combination of factors, in addition to applicable taxes. These include the cost of raw material, technology used by businesses, distribution channels, or competition in the market.

Imagine a case where the GST rate on a category of cars has come down from the current levels, but rising global prices of raw material such as steel have forced a manufacturer to increase prices. Given the mandate of the authority to ensure passing of lower tax rates to consumers, will it also consider the impact of rising input costs deciding the price of an item? Since factor costs keep fluctuating, in some cases the authority may find it difficult to evaluate the pricing decision of a business.

Q. Have other countries tried to introduce similar anti-profiteering frameworks?

Some countries such as Malaysia have in the past introduced laws to check if companies were making unreasonably high profits after the roll-out of GST.[15] While the law was supposed to remain in force for a limited period, the deadline has been extended a few times. In Australia, during the roll out of GST in the early 2000s, an existing authority was entrusted with the role of taking action against businesses that unreasonably increased prices.[16] The authority also put in place a strategy to raise consumer awareness about the available recourse in cases of price exploitation.

With rates for various items being approved, and the government considering a mechanism to ensure that any inflationary impact is minimised, the focus now shifts to the implementation of GST. This includes operationalisation of the GST Network, and notification of rules relating to registration under GST and payment of tax. The weeks ahead will be crucial for the authorities and various taxpayers in the country to ensure that GST is successfully rolled out from July 1, 2017.

[1] After fixing rates, GST Council to now focus on price behaviour of companies, The Hindustan Times, Ma 22, 2017, http://www.hindustantimes.com/business-news/after-fixing-rates-gst-council-to-now-focus-on-price-behaviour-of-companies/story-fRsAFsfEofPxMe2IXnXIMN.html.

[2] GST Rate Schedule for Goods, Central Board of Excise and Customs, GST Council, May 18, 2017, http://www.cbec.gov.in/resources//htdocs-cbec/gst/chapter-wise-rate-wise-gst-schedule-18.05.2017.pdf.

[3] GST Compensation Cess Rates for different supplies, GST Council, Central Board of Excise and Customs, May 18, 2017, http://www.cbec.gov.in/resources//htdocs-cbec/gst/gst-compensation-cess-rates-18.05.2017.pdf.

[4] Schedule of GST Rates for Services as approved by GST Council, GST Council, Central Board of Excise and Customs, May 19, 2017, http://www.cbec.gov.in/resources//htdocs-cbec/gst/Schedule%20of%20GST%20rates%20for%20services.pdf.

[5] GST rate impact: Here’s how the new tax can carry a greater punch, The Financial Express, May 24, 2017, http://www.financialexpress.com/economy/gst-rate-impact-heres-how-the-new-tax-can-carry-a-greater-punch/682762/.

[6] “So far, the GST Council has got it right”, The Hindu Business Line, May 22, 2017, http://www.thehindubusinessline.com/opinion/the-gst-council-has-got-it-right/article9709906.ece.

[7] “GST to cut inflation by 2%, create buoyancy in economy: Hasmukh Adhia”, The Times of India, May 21, 2017, http://timesofindia.indiatimes.com/business/india-business/gst-to-cut-inflation-by-2-create-buoyancy-in-economy-hasmukh-adhia/articleshow/58772448.cms.

[8] GST rate: New tax to reduce prices of most goods, from milk, coal to FMCG goods, The Financial Express, May 19, 2017, http://www.financialexpress.com/economy/gst-rate-new-tax-to-reduce-prices-of-most-goods-from-milk-coal-to-fmcg-goods/675722/.

[9] “Goods and Services Tax (GST) will lead to lower tax burden in several commodities including packaged cement, Medicaments, Smart phones, and medical devices, including surgical instruments”, Press Information Bureau, Ministry of Finance, May 23, 2017.

[10] “GST Townhall: Main concern is consumer education, says Adhia”, Live Mint, May 24, 2017.

[11] The Central Goods and Services Tax Act, 2017, http://www.prsindia.org/uploads/media/GST,%202017/Central%20GST%20Act,%202017.pdf.

[12] Rajasthan Goods and Services Tax Bill, 2017; Madhya Pradesh Goods and Services Tax Bill, 2017; Uttar Pradesh Goods and Services Tax Bill, 2017; Maharashtra Goods and Services Tax Bill, 2017.

[13] The Essential Commodities Act, 1955.

[14] “GST rollout: Anti-profiteering law could be the new face of tax terror”, The Financial Express, May 23, 2017, http://www.financialexpress.com/opinion/gst-rollout-anti-profiteering-law-could-be-the-new-face-of-tax-terror/680850/.

[15] Price Control Anti-Profiteering Act 2011, Malaysia.

[16] ACCC oversight of pricing responses to the introduction of the new tax system, Australia Competition and Consumer Commission, January 2003, https://www.accc.gov.au/system/files/GST%20final%20report.pdf.