Applications for the LAMP Fellowship 2025-26 will open soon. Sign up here to be notified when the dates are announced.

The National Medical Commission Bill, 2017 was introduced in Lok Sabha recently and is listed for consideration and passage today.[1] The Bill seeks to regulate medical education and practice in India. To meet this objective, the Bill repeals the Indian Medical Council Act, 1956 and dissolves the current Medical Council of India (MCI). The MCI was established under the 1956 Act, to establish uniform standards of higher education qualifications in medicine and regulating its practice.[2]

A Committee was set up in 2016, under the NITI Aayog with Dr. Arvind Panagariya as its chair, to review the 1956 Act and recommend changes to improve medical education and the quality of doctors in India.[3] The Committee proposed that the Act be replaced by a new law, and also proposed a draft Bill in August 2016.

This post looks at the key provisions of the National Medical Commission Bill, 2017 introduced in Lok Sabha recently, and some issues which have been raised over the years regarding the regulation of medical education and practice in the country.

What are the key issues regarding the regulation of medical education and practice?

Several experts have examined the functioning of the MCI and suggested a different structure and governance system for its regulatory powers.3,[4] Some of the issues raised by them include:

Separation of regulatory powers

Over the years, the MCI has been criticised for its slow and unwieldy functioning owing to the concentration and centralisation of all regulatory functions in one single body. This is because the Council regulates medical education as well as medical practice. In this context, there have been recommendations that all professional councils like the MCI, should be divested of their academic functions, which should be subsumed under an apex body for higher education to be called the National Commission for Higher Education and Research.[5] This way there would be a separation between the regulation of medical education from regulation of medical practice.

An Expert Committee led by Prof. Ranjit Roy Chaudhury (2015), recommended structurally reconfiguring the MCI’s functions and suggested the formation of a National Medical Commission through a new Act.3 Here, the National Medical Commission would be an umbrella body for supervision of medical education and oversight of medial practice. It will have four segregated verticals under it to look at: (i) under-graduate medical education, (ii) post-graduate medical education, (iii) accreditation of medical institutions, and (iv) the registration of doctors. The 2017 Bill also creates four separate autonomous bodies for similar functions.

Composition of MCI

With most members of the MCI being elected, the NITI Aayog Committee (2016) noted the conflict of interest where the regulated elect the regulators, preventing the entry of skilled professionals for the job. The Committee recommended that a framework must be set up under which regulators are appointed through an independent selection process instead.

Fee Regulation

The NITI Aayog Committee (2016) recommended that a medical regulatory authority, such as the MCI, should not engage in fee regulation of private colleges. Such regulation of fee by regulatory authorities may encourage an underground economy for medical education seats with capitation fees (any payment in excess of the regular fee), in regulated private colleges. Further, the Committee stated that having a fee cap may discourage the entry of private colleges limiting the expansion of medical education in the country.

Professional conduct

The Standing Committee on Health (2016) observed that the present focus of the MCI is only on licensing of medical colleges.4 There is no emphasis given to the enforcement of medical ethics in education and on instances of corruption noted within the MCI. In light of this, the Committee recommended that the areas of medical education and medical practice should be separated in terms of enforcement of the appropriate ethics for each of these stages.

What does the National Medical Commission, 2017 Bill seek do to?

The 2017 Bill sets up the National Medical Commission (NMC) as an umbrella regulatory body with certain other bodies under it. The NMC will subsume the MCI and will regulate the medical education and practice in India. Under the Bill, states will establish their respective State Medical Councils within three years. These Councils will have a role similar to the NMC, at the state level.

Functions of the NMC include: (i) laying down policies for regulating medical institutions and medical professionals, (ii) assessing the requirements of human resources and infrastructure in healthcare, (iii) ensuring compliance by the State Medical Councils with the regulations made under the Bill, and (iv) framing guidelines for determination of fee for up to 40% of the seats in the private medical institutions and deemed universities which are governed by the Bill.

Who will be a part of the NMC?

The NMC will consist of 25 members, appointed by the central government. It will include representatives from Indian Council of Medical Research, and Directorate General of Health Services. A search committee will recommend names to the central government for the post of Chairperson, and the part-time members. These posts will have a maximum term of four years, and will not be eligible for extension or reappointment.

What are the regulatory bodies being set up under the NMC?

The Bill sets up four autonomous boards under the supervision of the NMC, as recommended by various experts. Each autonomous board will consist of a President and two members, appointed by the central government (on the recommendation of the search committee). These bodies are:

What does the Bill say regarding the conduct of medical entrance examinations?

There will be a uniform National Eligibility-cum-Entrance Test (NEET) for admission to under-graduate medical education in all medical institutions governed by the Bill. The NMC will specify the manner of conducting common counselling for admission in all such medical institutions.

Further, there will be a National Licentiate Examination for the students graduating from medical institutions to obtain the license for practice. This Examination will also serve as the basis for admission into post-graduate courses at medical institutions.

————————————————————–

[1] The National Medical Commission Bill, 2017, http://www.prsindia.org/uploads/media/medical%20commission/National%20Medical%20Commission%20Bill,%202017.pdf.

[2] Indian Medical Council Act, 1933.

[3] A Preliminary Report of the Committee on the Reform of the Indian Medical Council Act, 1956, NITI Aayog, August 7, 2016, http://niti.gov.in/writereaddata/files/document_publication/MCI%20Report%20.pdf.

[4] “Report no. 92: Functioning of the Medical Council of India”, Standing Committee on Health and Family Welfare, March 8, 2016, http://164.100.47.5/newcommittee/reports/EnglishCommittees/Committee%20on%20Health%20and%20Family%20Welfare/92.pdf

[5] “Report of the Committee to Advise on Renovation and Rejuvenation of Higher Education”, Ministry of Human Resource Development, 2009, http://mhrd.gov.in/sites/upload_files/mhrd/files/document-reports/YPC-Report.pdf.

The central government has enforced a nation-wide lockdown between March 25 and May 3 as part of its measures to contain the spread of COVID-19. During the lockdown, several restrictions have been placed on the movement of individuals and economic activities have come to a halt barring the activities related to essential goods and services. The restrictions are being relaxed in less affected areas in a limited manner since April 20. In this blog, we look at how the lockdown has impacted the demand and supply of electricity and what possible repercussions its prolonged effect may have on the power sector.

Power supply saw a decrease of 25% during the lockdown (year-on-year)

As electricity cannot be stored in large amount, the power generation and supply for a given day are planned based on the forecast for demand. The months of January and February in 2020 had seen an increase of 3% and 7% in power supply, respectively as compared to 2019 (year-on-year). In comparison, the power supply saw a decrease of 3% between March 1 and March 24. During the lockdown between March 24 and April 19, the total power supply saw a decrease of about 25% (year-on-year).

Figure 1: % change in power supply position between March 1 and April 19 (Y-o-Y from 2019 to 2020)

Sources: Daily Reports; POSOCO; PRS.

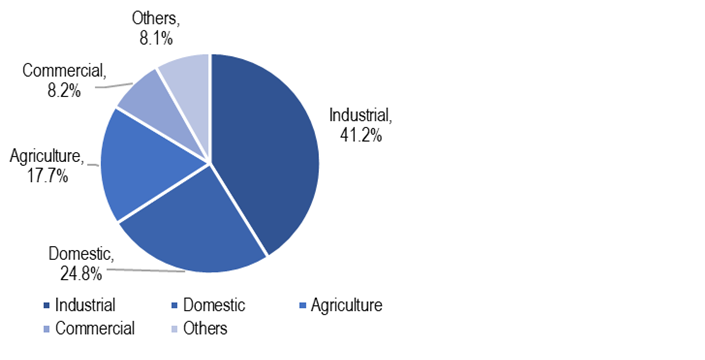

If we look at the consumption pattern by consumer category, in 2018-19, 41% of total electricity consumption was for industrial purposes, followed by 25% for domestic and 18% for agricultural purposes. As the lockdown has severely reduced the industrial and commercial activities in the country, these segments would have seen a considerable decline in demand for electricity. However, note that the domestic demand may have seen an uptick as people are staying indoors.

Figure 2: Power consumption by consumer segment in 2018-19

Sources: Central Electricity Authority; PRS.

Electricity demand may continue to be subdued over the next few months. At this point, it is unclear that when lockdown restrictions are eased, how soon will economic activities return to pre COVID-19 levels. India’s growth projections also highlight a slowdown in the economy in 2020 which will further impact the demand for electricity. On April 16, the International Monetary Fund has slashed its projection for India’s GDP growth in 2020 from 5.8% to 1.9%.

A nominal increase in energy and peak deficit levels

As power sector related operations have been classified as essential services, the plant operations and availability of fuel (primarily coal) have not been significantly constrained. This can be observed with the energy deficit and peak deficit levels during the lockdown period which have remained at a nominal level. Energy deficit indicates the shortfall in energy supply against the demand during the day. The average energy deficit between March 25 and April 19 has been 0.42% while the corresponding figure was 0.33% between March 1 and March 24. Similarly, the average peak deficit between March 25 and April 19 has been 0.56% as compared to 0.41% between March 1 and March 24. Peak deficit indicates the shortfall in supply against demand during highest consumption period in a day.

Figure 3: Energy deficit and peak deficit between March 1, 2020 and April 19, 2020 (in %)

Sources: Daily Reports; POSOCO; PRS.

Coal stock with power plants increases

Coal is the primary source of power generation in the country (~71% in March 2020). During the lockdown period, the coal stock with coal power plants has seen an increase. As of April 19, total coal-stock with the power plants in the country (in days) has risen to 29 days as compared to 24 days on March 24. This indicates that the supply of coal has not been constrained during the lockdown, at least to the extent of meeting the requirements of power plants.

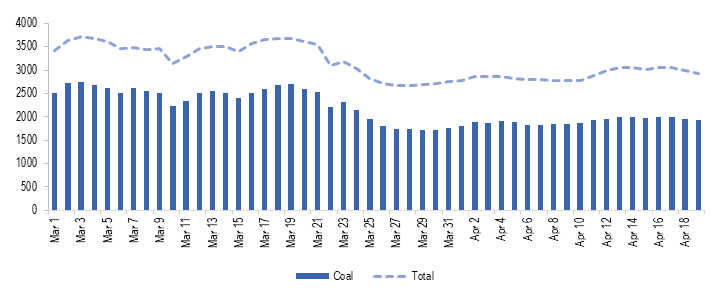

Energy mix changes during the lockdown, power generation from coal impacted

During the lockdown, power generation has been adjusted to compensate for reduced consumption, Most of this reduction in consumption has been adjusted by reduced coal power generation. As can be seen in Table 1, coal power generation reduced from an average of 2,511 MU between March 1 and March 24 to 1,873 MU between March 25 and April 19 (about 25%). As a result, the contribution of coal in total power generation reduced from an average of 72.5% to 65.6% between these two periods.

Table 1: Energy Mix during March 1-April 19, 2020

Sources: Daily Reports; POSOCO; PRS.

This shift may be happening due to various reasons including: (i) renewable energy sources (solar, wind, and small hydro) have MUST RUN status, i.e., the power generated by them has to be given the highest priority by distribution companies, and (ii) running cost of renewable power plants is lower as compared to thermal power plants.

This suggests that if growth in electricity demand were to remain weak, the adverse impact on the coal power plants could be more as compared to other power generation sources. This will also translate into weak demand for coal in the country as almost 87% of the domestic coal production is used by the power sector. Note that the plant load factor (PLF) of the thermal power plants has seen a considerable decline over the years, decreasing from 77.5% in 2009-10 to 56.4% in 2019-20. Low PLF implies that coal plants have been lying idle. Coal power plants require significant fixed costs, and they incur such costs even when the plant is lying idle. The declining capacity utilisation augmented by a weaker demand will undermine the financial viability of these plants further.

Figure 4: Power generation from coal between March 1, 2020 and April 19, 2020 (in MU)

Sources: Daily Reports; POSOCO; PRS.

Finances of the power sector to be severely impacted

Power distribution companies (discoms) buy power from generation companies and supply it to consumers. In India, most of the discoms are state-owned utilities. One of the key concerns in the Indian power sector has been the poor financial health of its discoms. The discoms have had high levels of debt and have been running losses. The debt problem was partly addressed under the UDAY scheme as state governments took over 75% of the debt of state-run discoms (around 2.1 lakh crore in two years 2015-16 and 2016-17). However, discoms have continued to register losses owing to underpricing of electricity tariff for some consumer segments, and other forms of technical and commercial losses. Outstanding dues of discoms towards power generation companies have also been increasing, indicating financial stress in some discoms. At the end of February 2020, the total outstanding dues of discoms to generation companies stood at Rs 92,602 crore.

Due to the lockdown and its further impact in the near term, the financial situation of discoms is likely to be aggravated. This will also impact other entities in the value chain including generation companies and their fuel suppliers. This may lead to reduced availability of working capital for these entities and an increase in the risk of NPAs in the sector. Note that, as of February 2020, the power sector has the largest share in the deployment of domestic bank credit among industries (Rs 5.4 lakh crore, 19.3% of total).

Following are some of the factors which have impacted the financial situation during the lockdown:

Reduced cross-subsidy: In most states, the electricity tariff for domestic and agriculture consumers is lower than the actual cost of supply. Along with the subsidy by the state governments, this gap in revenue is partly compensated by charging industrial and commercial consumers at a higher rate. Hence, industrial and commercial segments cross-subsidise the power consumption by domestic and agricultural consumers.

The lockdown has led to a halt on commercial and industrial activities while people are staying indoors. This has led to a situation where the demand from the consumer segments who cross-subsidise has decreased while the demand from consumer segments who are cross-subsidised has increased. Due to this, the gap between revenue realised by discoms and cost of supply will widen, leading to further losses for discoms. States may choose to bridge this gap by providing a higher subsidy.

Moratorium to consumers: To mitigate the financial hardship of citizens due to COVID-19, some states such as Rajasthan, Uttar Pradesh, and Goa, among others, have provided consumers with a moratorium for payment of electricity bills. At the same time, the discoms are required to continue supplying electricity. This will mean that the return for the supply made in March and April will be delayed, leading to lesser cash in hand for discoms.

Some state governments such as Bihar also announced a reduction in tariff for domestic and agricultural consumers. Although, the reduction in tariff will be compensated to discoms by government subsidy.

Constraints with government finances: The revenue collection of states has been severely impacted as economic activities have come to a halt. Further, the state governments are directing their resources for funding relief measures such as food distribution, direct cash transfers, and healthcare. This may adversely affect or delay the subsidy transfer to discoms.

The UDAY scheme also requires states to progressively fund greater share in losses of discoms from their budgetary resources (10% in 2018-19, 25% in 2019-20, and 50% in 2020-21). As losses of discoms may widen due to the above-mentioned factors, the state government’s financial burden is likely to increase.

Capacity addition may be adversely impacted

As per the National Electricity Plan, India’s total capacity addition target is around 176 GW for 2017-2022. This comprises of 118 GW from renewable sources, 6.8 GW from hydro sources, and 6.4 GW from coal (apart from 47.8 GW of coal-based power projects already in various stages of production as of January 2018).

India has set a goal of installing 175 GW of Renewable Power Capacity by 2022 as part of its climate change commitments (86 GW has been installed as of January 2020). In January 2020, the Parliamentary Standing Committee on Energy observed that India could only install 82% and 55% of its annual renewable energy capacity addition targets in 2017-18 and 2018-19. As of January 2020, 67% of the target has been achieved for 2019-20.

Due to the impact of COVID-19, the capacity addition targets for various sources is likely to be adversely impacted in the short run as:

construction activities were stopped during the lockdown and will take some time to return to normal,

disruption in the global supply chain may lead to difficulties with the availability of key components leading to delay in execution of projects, for instance, for solar power plants, solar PV modules are mainly imported from China, and

reduced revenue for companies due to weak demand will leave companies with less capacity left for capital expenditure.

Key reforms likely to be delayed

Following are some of the important reforms anticipated in 2020-21 which may get delayed due to the developing situation:

The real-time market for electricity: The real-time market for electricity was to be operationalised from April 1, 2020. However, the lockdown has led to delay in completion of testing and trial runs. The revised date for implementation is now June 1, 2020.

UDAY 2.0/ADITYA: A new scheme for the financial turnaround of discoms was likely to come this year. The scheme would have provided for the installation of smart meters and incentives for rationalisation of the tariff, among other things. It remains to be seen what this scheme would be like since the situation with government finances is also going to worsen due to anticipated economic slowdown.

Auction of coal blocks for commercial mining: The Coal Ministry has been considering auction of coal mines for commercial mining this year. 100% FDI has been allowed in the coal mining activity for commercial sale of coal to attract foreign players. However, the global economic slowdown may mean that the auctions may not generate enough interest from foreign as well as domestic players.

For a detailed analysis of the Indian Power Sector, please see here. For details on the number of daily COVID-19 cases in the country and across states, please see here. For details on the major COVID-19 related notifications released by the centre and the states, please see here.