The draft Direct Taxes Code Bill seeks to consolidate and amend the law relating to all direct taxes and will replace the Income Tax Act, 1961. The draft Bill, along with a discussion paper, was released for public comments in August 2009.[1] Following inputs received, the government proposed revisions to the draft Bill in June 2010. The table below summarises these revisions. The government has not released the changes proposed in the form of a revised draft bill however, but as a new discussion paper. The note is based on this discussion paper.[2] The Code had proposed a number changes in the current direct tax regime, such as a minimum alternate tax (MAT) on companies’ assets (currently imposed on book profits), and the taxation of certain types of personal savings at the time they are withdrawn by an investor. Under the new amendments, some of these changes, such as MAT, have been reversed. Personal savings in specified instruments (such as a public provident fund) will now continue to remain tax-free at all times. The tax deduction on home loan interest payments, which was done away with by the Code, has now been restored. However, the discussion paper has not specified whether certain other changes proposed by the Code (such as a broadening of personal income tax slabs), will continue to apply.

| Issue | Income Tax Act, 1961 | Draft Direct Taxes Code (August 09) | Revisions Proposed (June 2010) |

| Minimum Alternate Tax (MAT) | MAT currently imposed at 18% of profits declared by companies to shareholders. | To be imposed on assets rather than profits of companies. Tax rate proposed at 2% (0.25% for banks) | MAT to be imposed on book profit as is the case currently. Rate not specified. |

| Personal Saving / retirement benefits | Certain personal savings, such as public provident funds, are not taxed at all. | Such savings to be taxed at the time of withdrawal by the investor. | Such savings to remain tax-exempt at all stages, as is the case currently. |

| Income from House Property | Taxable rent is higher of actual rent or ‘reasonable’ rent set by municipality(less specified deductions). Rent is nil for one self-occupied property. | Taxable rent is higher of actual rent or 6% of cost /value set by municipality (less specified deductions). Rent is nil for one self-occupied property. | Taxable rent is no longer presumed to be 6% in case of non-let out property. Tax deductions allowed on interest on loans taken to fund such property. |

| Interest on Home loans | Interest on home loans is tax deductible | Tax deductions on home loan interest not allowed. | Tax deductions for interest on loans allowed, as is currently the case. |

| Capital Gains | Long term and short term gains taxed at different rates. | Distinction between long and short term capital gains removed and taxed at the applicable rate; Securities Transaction Tax done away with. | Equity shares/mutual funds held for more than a year to be taxed at an applicable rate, after deduction of specified percentage of capital gains. No deductions allowed for investment assets held for less than a year. Securities Transaction tax to be ‘calibrated’ based on new regime. Income on securities trading of FIIs to be classified as capital gains and not business income. |

| Non-profit Organisations | Applies to organizations set up for ‘charitable purposes’. Taxed (at 15% of surplus) only if expenditure is less than 85% of income. | To apply to organizations carrying on ‘permitted welfare activities’. To be taxed at 15% of income which remains unspent at the end of the year. This surplus is to be calculated on the basis of cash accounting principles. | Definition of ‘charitable purpose’ to be retained, as is the case currently. Exemption limit to be given and surplus in excess of this will be taxed. Up to 15% of surplus / 10% of gross receipts can be carried forward; to be used within 3 years. |

| Units in Special Economic Zones | Tax breaks allowed for developers of Special Economic Zones and units in such zones. | Tax breaks to be done away with; developers currently availing of such benefits allowed to enjoy benefits for the term promised (‘grandfathering’). | Grandfathering of exemptions allowed for units in SEZs as well as developers. |

| Non-resident Companies | Companies are residents if they are Indian companies or are controlled and managed wholly out of India. | Companies are resident if their place of control and management is situated wholly or partly in India, at any time in the year. The Bill does not define ‘partly’ | Companies are resident if ‘place of effective management’ is in India i.e. place where board make their decisions/ where officers or executives perform their functions. |

| Double Taxation Avoidance Agreements | In case of conflict between provisions of the Act, and those in a tax agreement with another country, provisions which are more beneficial to the taxpayer shall apply | The provision which comes into force at a later date shall prevail. Thus provisions of the Code would override those of existing tax agreements. | Provisions which more beneficial shall apply, as is the case currently. However, tax agreements will not prevail if anti-avoidance rule is used, or in case of certain provisions which apply to foreign companies. |

| General Anti-Avoidance Rule | No provision | Commissioner of Income Tax can declare any arrangement by a taxpayer as ‘impermissible’, if in his judgement, its main purpose was to have obtained a tax benefit. | CBDT to issue guidelines as to when GAAR can be invoked; GAAR to be invoked only in cases of tax avoidance beyond a specified limit; disputes can be taken to Dispute Resolution Panel. |

| Wealth Tax | Charged at 1% of net wealth above Rs 15 lakh | To be charged at 0.25% on net wealth above Rs 50 crore; scope of taxable wealth widened to cover financial assets. | Wealth tax to be levied ‘broadly on same lines’ as Wealth Tax Act, 1957. Specified unproductive assets to be subject to wealth tax; nonprofit organizations to be exempt. Tax rate and exemption limit not specified. |

| Source: Income Tax Act, 1961, Draft Direct Taxes Code Bill (August 2009), New Discussion Paper (June 2010), PRS | |||

[1] See PRS Legislative Brief on Draft Direct Taxes Code (version of August 2009) at http://prsindia.org/index.php?name=Sections&id=6 [2] Available at http://finmin.nic.in/Dtcode/index.html

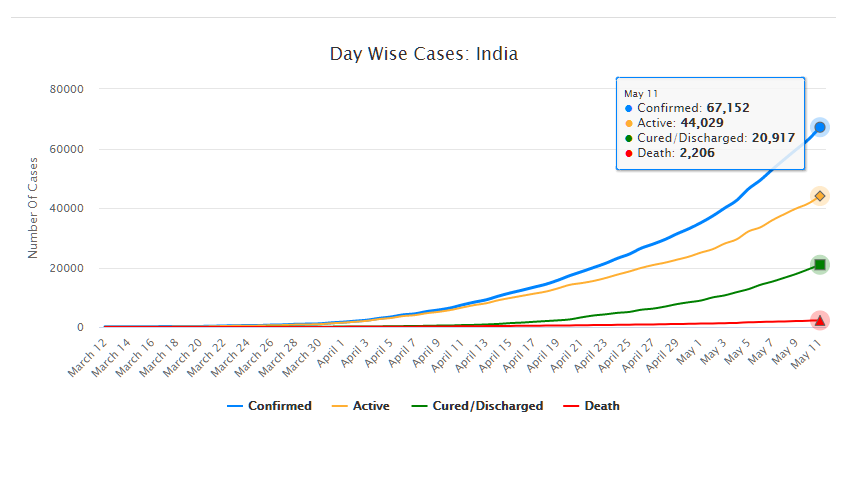

As of May 11, 2020, there are 67,152 confirmed cases of COVID-19 in India. Since May 4, 24,619 new cases have been registered. Out of the confirmed cases so far, 20,917 patients have been cured/discharged and 2,206 have died. As the spread of COVID-19 has increased across the country, the central government has continued to announce several policy decisions to contain the spread, and support citizens and businesses who are being affected by the pandemic. In this blog post, we summarise some of the key measures taken by the central government in this regard between May 4 and May 11, 2020.

Source: Ministry of Health and Family Welfare; PRS.

Industry

Relaxation of labour laws in some states

The Gujarat, Himachal Pradesh, Rajasthan, Haryana, and Uttarakhand governments have passed notifications to increase maximum weekly work hours from 48 hours to 72 hours and daily work hours from 9 hours to 12 hours for certain factories. This was done to combat the shortage of labour caused by the lockdown. Further, some state governments stated that longer shifts would ensure a fewer number of workers in factories so as to allow for social distancing.

Madhya Pradesh has promulgated the Madhya Pradesh Labour Laws (Amendment) Ordinance, 2020. The Ordinance exempts establishments with less than 100 workers from adhering to the Madhya Pradesh Industrial Employment (Standing Orders) Act, 1961, which regulates the conditions of employment of workers. Further, it allows the state government to exempt any establishment or class of establishments from the Madhya Pradesh Shram Kalyan Nidhi Adhiniyam, 1982, which provides for the constitution of a welfare fund for labour.

The Uttar Pradesh government has published a draft Ordinance which exempts all factories and establishments engaged in manufacturing processes from all labour laws for a period of three years. Certain conditions will continue to apply with regard to payment of wages, safety, compensation and work hours, amongst others. However, labour laws providing for social security, industrial dispute resolution, trade unions, strikes, amongst others, will not apply under the Ordinance.

Financial aid

Central government signs an agreement with Asian Infrastructure Investment Bank for COVID-19 support

The central government and Asian Infrastructure Investment Bank (AIIB) signed a 500 million dollar agreement for the COVID-19 Emergency Response and Health Systems Preparedness Project. The project aims to help India respond to the COVID-19 pandemic and strengthen India’s public health system to manage future disease outbreaks. The project is being financed by the World Bank and AIIB in the amount of 1.5 billion dollars, of which one billion dollars is being provided by World Bank and 500 million dollars is being provided by AIIB. This financial support will be available to all states and union territories and will be used to address the needs of at-risk populations, medical personnel, and creating medical and testing facilities, amongst others. The project will be implemented by the National Health Mission, the National Center for Disease Control, and the Indian Council of Medical Research, under the Ministry of Health and Family Welfare.

Travel

Restarting of passenger travel by railways

Indian Railways plans to restart passenger trains from May 12 onwards. It will begin with 15 pairs of trains which will run from New Delhi station connecting Dibrugarh, Agartala, Howrah, Patna, Bilaspur, Ranchi, Bhubaneswar, Secunderabad, Bengaluru, Chennai, Thiruvananthapuram, Madgaon, Mumbai Central, Ahmedabad and Jammu Tawi. Booking for reservation in these trains will start at 4 pm on May 11. Thereafter, Indian Railways plans to start more services on new routes.

Return of Indians stranded abroad

The central government will facilitate the return of Indian nationals stranded abroad in a phased manner beginning on May 7. The travel will be arranged by aircraft and naval ships. The stranded Indians utilising the service will be required to pay for it. Medical screening of the passengers will be done before the flight. On reaching India, passengers will be required to download the Aarogya Setu app. Further, they will be quarantined by the concerned state government in either a hospital or a quarantine institution for 14 days on a payment basis. After quarantine, passengers will be tested for COVID-19 and further action will be taken based on the results.

For more information on the spread of COVID-19 and the central and state government response to the pandemic, please see here.